Debtor Turnover Days Formula

In other words when making a credit sale it will take the company 182 days to collect the. All three are used together to extract meaningful analysis in the data set.

Receivable Turnover Ratio Formula Meaning Example And Interpretation

Relevance and Use of Growth Rate Formula.

. And total revenue minus company paid. How to Calculate Days Inventory Outstanding DIO On the balance sheet the inventory line item represents the dollar value of the raw materials work-in-progress goods and finished goods of a company. Growth Rate Final Value Initial Value Initial Value.

If the daily standard deviation of the SP 500 benchmark is 173 in August 2015 its Annualized Volatility will be. Assuming there are 252 trading days in a year. Days in Inventory 365 029.

Customers who are buying the products from the company can either pay upfront or can pay after some time. Calculation of inventory turnover and days inventories outstanding for XYZ Inc. It is an arithmetic average of the data set and can be calculated by taking a sum of all the data points and then dividing it by the number of data points we have in the data set.

From the above example the Debtors Turnover Ratio comes out to 52 and the average accounts receivable are Rs. It measures how well your clients pay their invoices within an allotted timeframe for example net 30 or net 60. Hence in some formulas where operating expense is used taxes are added to the formula while in another formula where gross profit is used operating expense is deducted from gross profit along with deduction of amortization and depreciation of assets from gross profit which results in operating income.

RoE 01 x 287 x 15. Next determine the actual selling price of the product at which it is being traded in the market place. Here we discuss How to Calculate Absorption Costing along with practical examples.

Debtors Turnover Ratio or Receivables Turnover Ratio Debtors turnover ratio is also known as Receivables Turnover Ratio Debtors Velocity and Trade Receivables Ratio. Days in Inventory 1278 days. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

You may also look at the following articles to learn more Working Capital Turnover Ratio. Explanation of Efficiency Ratios Formula 1 Asset Turnover Ratio. Finally the growth rate formula can be obtained by dividing the change in value step 3 by the initial value step 1 of the metric and then express the result in terms of percentage by multiplying by 100 as shown below.

Standard Deviation is the degree to which the prices vary from the average over the given period of time. Days Payable Outstanding DPO Average Accounts Payable Cost of Goods Sold 365 Days. If we divide 30k by 200k we get 15 or 15.

The same can be observed from the below formula Days in Inventory 365 Inventory Turnover Ratio. All in One Financial Analyst Bundle 250 Courses 40 Projects 250 Online Courses. Net Realizable Value Formula.

The three central measures of tendency are mean median and mode. Asset Turnover Ratio is calculated using the formula given below. Get 247 customer support help when you place a homework help service order with us.

The first formula for producer surplus can be derived by using the following steps. Sales Growth Rate Current Net Sales Previous Net Sales Previous Net Sales x 100. The formula to calculate sales growth rate is.

Based on the information provided as below. It helps in cash budgeting as cash flow from customers can be. This has been a guide to Absorption Costing Formula.

RoE 04305 or 4305. Mode Formula Table of Contents Formula. One distinction between the DPO calculation and days sales outstanding DSO calculation is that COGS is used instead of revenue since to calculate DPO COGS tends to be a better proxy for a companys spending related to suppliesvendors.

Examples of Debtor Days Formula With Excel Template Debtor Days Formula Calculator. Firstly determine the minimum at which the producer is willing or able to sell the subject good. Lets say a company has an AR balance of 30k and 200k in revenue.

Apple Inc Balance sheet Explanation. Calculation of Salary Using Formula. We then multiply 15 by 365 days to get approximately 55 for DSO.

To calculate the asset turnover ratio the following steps should be undertaken. Debtors ratio is an important KPI. Days Sales Outstanding DSO Average Accounts Receivable Revenue 365 Days.

RoE Profit Margin x Asset Turnover x Financial Leverage. A comparative benchmarking analysis of a companys inventory turnover and DIO relative to its industry peers provides useful insights into how well inventory is being managed. Explanation of Asset Turnover Ratio Formula.

Mean Formula Mean is a point in a data set that is the average of all the data points we have in a set. Against the simplicity of the formula the calculation and practical usability of this formula have certain questions. Asset Turnover Ratio Sales Total Assets.

Another Example of Inventory Turnover Ratio Formula. Gautam has started a new business in the gym around a year ago. What is the Mode Formula.

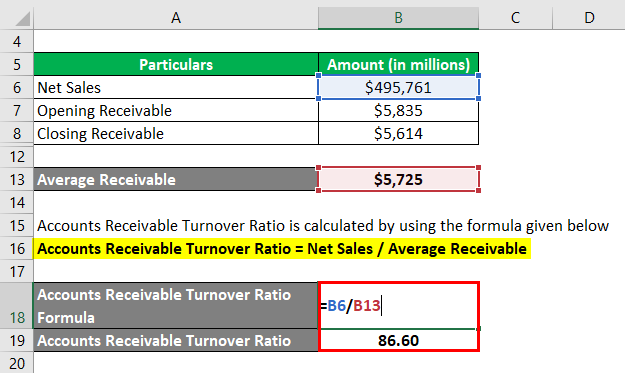

Average Collection Period 12 months or 52 weeks or 365 days Debtors Turnover Ratio. Today in this article we will discuss mode which is also one of the keys and the important method central. Accounts Receivable Turnover Ratio Formula Net Credit Sales Average Accounts Receivable In the above ratio we have two components.

Formula for average collection period. 1000000- let us calculate the average collection period for a year with 365 days. The formula for a stock turnover ratio can be derived by using the following steps.

Thats why the accounts receivable turnover aka. Profit Margin 10 Profit Margin Formula Example 2. It is an activity ratio that finds out the relationship between net credit sales and average trade receivables of a business.

Asset Turnover Ratio is a measure that is used to determine how efficiently a company is. Asset Turnover Ratio 260174 million 338516 million. Which means that the company can collect its receivables twice in the given year or once in 182 days 3652.

Average Collection Period 365 Days or 12 Months Debtor Receivable Turnover Ratio For calculation of the receivable turnover ratio you can use our. It is also known as Days Sales Outstanding. Modified Duration 284 1 5 Modified Duration 270 Therefore it can be seen that the modified duration of a bond decreases with the increase in the coupon rate.

He was inexperienced in the business and he feels he has made adequate sales to recover from loss and appears to be making a profit. Modified Duration 288 1 5 Modified Duration 275 For Coupon Rate 6. With the help of the debtors turnover ratio debtor days can be calculated.

How to Calculate Coupon Rate. It will depend on various factors like the products utility uniqueness. We also provide downloadable excel template.

Every company needs sales to run its business. Debtor days give the average number of days a business takes to collect its debts. Net Realizable Value Formula.

Debtor Days Formula Table of Contents Debtor Days Formula. Firstly determine the cost of goods sold incurred by the company during the periodIt is the sum of all the direct and indirect costs that can be apportioned to the job order or product. For Coupon Rate 4.

Guide to Accounts Receivables Turnover Formula.

Accounts Receivable Turnover Ratio Top 3 Examples With Excel Template

Accounts Receivable Turnover Ratio Accounting Play

Receivables Turnover Formula And Calculator Excel Template

Accounts Receivable Turnover Ratio Top 3 Examples With Excel Template

No comments for "Debtor Turnover Days Formula"

Post a Comment